The Central Bank of Nigeria issued a memo on December 1, 2023 to all banks to downgrade all accounts not connected to BVN and NIN to a tier one account. While some banks have announced February 29, 2024 as the deadline for the grace period before taking action on the apex bank memo, others are silent.

The memo which made it mandatory to have both NIN and BVN linked to all bank accounts said it is to ensure financial system stability.

“As part of its effort in promoting financial system stability, it becomes necessary to strengthen the Know Your Customer (KYC) procedures in financial institutions under the purview of the Central Bank of Nigeria (CBN),” the memo reads.

“In this regard: It is mandatory for ALL Tier-1 bank accounts and wallets for individuals to have BVN and/or NIN. It remains mandatory for Tiers 2 & 3 accounts and wallets for Individual accounts to have BVN and NIN,” it added.

Tier 1 accounts are those that can be opened with a valid identity or proof of address with a maximum daily transaction limit of N50,000 and maximum account balance of N300,000.

Four ways to link BVN/NIN to your Account

Many Nigerians are struggling to connect to both BVN and NIN to their bank accounts as many thought it should have been done automatically, while ruing the prospect of having to queue for long hours at their banks’ branches to get it done.

If you are one of them, worry not. We have outlined ways to solve this issue.

There are basically four ways to get your NIN / BVN linked to your bank accounts:

- The traditional mode of visiting of bank branches and requesting for the NIN form

- Using USSD codes and SMS

- Internet Banking

- Bank mobile apps

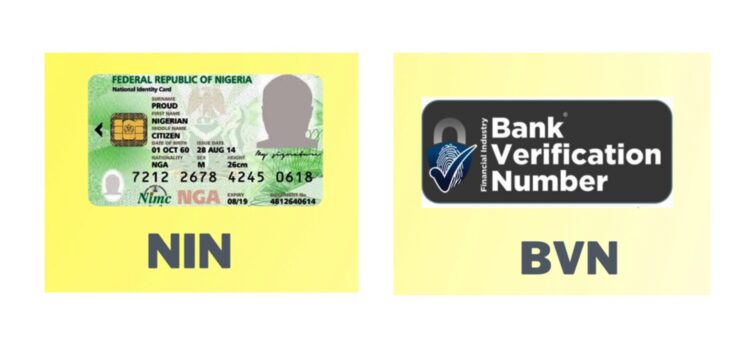

What is NIN and BVN?

National Identification Number (NIN): A randomly generated, 11-digit code assigned to individuals upon enrollment in the National Identity Database (NIDB).

Bank Verification Number (BVN): A unique identifier linked to biometric data, used for enhanced security verification in real-time transactions.

The following Nigerian Banks have sent messages to customers on how to link NIN and BVN to their bank accounts and avoid getting downgraded:

Access Bank

Below are instructions to link your BVN/NIN to your account if you bank with Access Bank:

- Dial *901*11# from your registered phone number.

- Follow the prompts on the screen and enter your NIN and BVN when requested.

- Confirm your details and submit.

- You will receive confirmation that your NIN has been successfully linked to your Access Bank account.

Or Visit the Access Bank website at www.accessbankplc.com or https://www.accessbankplc.com/help/bank-verification-number.

Click on the “NIN/BVN Linkage” banner on the homepage or go to www.accessbankplc.com/nin-by-linkage. Enter your Access Bank account number, NIN, and BVN in the fields provided.

Click on the “Submit” button and wait for the verification process.

You will receive confirmation that your NIN has been successfully linked to your Access Bank account.

Ecobank

Ecobank have informed their customers to follow these steps:

Kindly click on the customer update link, https://customerupdate.ecobank.com/ciu/login.

- Input your account details, Tick the terms and conditions box

- An OTP will be sent to your registered email address, Input OTP and submit

- Click on Request, Select statutory ID or identification update and upload a copy of your NIN document.

- Tick the acceptance box and submit

GTbank

GTbank process of linking BVN and NIN to a bank account can be completed using any of these channels:

- Dial *737*20*BVN# from your registered mobile number to link your BVN

- Visit our website, www.gtbank.com self-service portal, to link your BVN and NIN

- Visit the nearest GTBank branch to link your BVN and NIN to your account

United Bank for Africa (UBA)

The bank have told customers can send Hi to Leo and select NIN.

Zenith bank

For Zenith bank, to link your NIN or BVN to your account, follow these steps:

Dial *966*NIN# and follow the prompts to link your BVN to your account or via internet banking, log in to the platform, click “Account” on the Menu and select “Update Account (NIN)” or “BVN Update”. Then complete and submit the e-form.

While other banks have not publicly announced ways by which you can link your NIN/ BVN to your bank account, you can always send a mail to your account officer or send a direct message (DM) to your bank via X(twitter) to have more info.

However, if you are using one of the fintech apps and you want to feel secure while inputting your NIN in the mobile app, you can generate a Virtual NIN (VNIN).

The Virtual NIN: Protecting your identity

Imagine a unique code that verifies your identity without revealing your actual National Identification Number (NIN). That’s the concept behind the Virtual NIN, a 16-digit alphanumeric code generated for each verification request. This temporary code expires after 72 hours, enhancing your data privacy and security.

How it works:

Whenever you need to verify your identity online, like with banks, airports, or delivery services, you can generate a Virtual NIN through:

USSD: Dial *346*3*Your NIN*AgentCode# on your phone. You’ll receive a text message with your unique Virtual NIN.

NIMC MWS Mobile ID App: Launch the app, enter your PIN, and select “GET VIRTUAL NIN” from the home screen.

Remember, this temporary code is only valid for the specific verification request and cannot be stored or reused by the verifying party.

Benefits of Virtual NIN:

The use of Virtual NIN confers has some inherent benefits, which include enhanced security, as it protects your actual NIN from unauthorized access; increased privacy that is guaranteed by limitations to the information shared during verification and the fact that it is convenient and easy to generate the VNIN through USSD or a mobile app.

By using Virtual NIN, you can enjoy secure and streamlined identity verification while keeping your personal information safe.

I love the process of NIN and BVN links to account to prevent fraud. God bless UBA PLC Africa’s no 1 global Banking. thanks.

Good